18+ taxes on mortgage

Web Mortgage interest is tax deductible. Web Most homeowners can deduct all of their mortgage interest.

How Would Paydown Affect The Reform Of Home Mortgage Interest Deduction Tax Policy Center

Start basic federal filing for free.

. Top Second Mortgage Loans Reviewed By Industry Experts. Filing your taxes just became easier. Ad Check Official Requirements See If You Qualify for a 0 Down VA Home Loan.

Is mortgage interest tax deductible. If the borrowers make a down. The Tax Cuts and Jobs Act TCJA which is in effect from 2018 to 2025 allows homeowners to deduct interest on.

These amounts include a New York state levy of. Web Here is an overview of which mortgage costs might be tax deductible for you in 2023. Web The city levies a 18 tax on mortgages less than 500000 and 1925 on mortgages greater than 500000.

Ad From Simple To Complex Taxes TurboTax Can Handle Your Unique Tax Situation. Skip The Bank Save. Use Zillows home loan calculator to quickly estimate your total mortgage payment including principal and interest plus estimates for PMI property.

Web Use Form 1098 Info Copy Only to report mortgage interest of 600 or more received by you during the year in the course of your trade or business from an individual including a. Web 20 hours agoA 15-year fixed-rate mortgage with todays interest rate of 621 will cost 855 per month in principal and interest on a 100000 mortgage not including taxes. TurboTax Will Get Your Maximum Refund Guaranteed Or Your Money Back.

Ad Use Our Comparison Site Find Out Which Lender Suits You The Best. Web Thats a gross monthly income of 5000 a month. In some cases borrowers may put down as low as 3.

Ad Over 90 million taxes filed with TaxAct. At a personal tax rate of 24 this implies tax savings of 3566. For example Lenas first-year interest expense totals 14857.

Web For example if you are single and have a mortgage on your main home for 800000 plus a mortgage on your summer home for 400000 you would only be able. Skip The Bank Save. Top Second Mortgage Loans Reviewed By Industry Experts.

Singapore home sales reached a five-month high as demand returned after a dwindling supply slowed transactions late last year. 5000 x 028 1400 total monthly mortgage payment PITI Joes total monthly mortgage payments including principal. Web Youre limited to deducting interest on total mortgage debt of 750000 or less if the debt originated on or after Dec.

Web The more conservative 25 model says you should spend no more than 25 of your post-tax income on your monthly mortgage payment. The limit for older mortgage debt is. Current IRS rules allow many homeowners to deduct.

The Best Second Mortgage Rates. File your taxes stress-free online with TaxAct. See what your estimated monthly payment would be with the VA Loan.

Web 5 hours agoSGD. For example if you earn. The Best Second Mortgage Rates.

Web An estimated total if applicable of the amounts paid for mortgage interest points andor mortgage insurance premiums normally reported to you on Form 1098. Web Typically mortgage lenders want the borrower to put 20 or more as a down payment. Ad Use Our Comparison Site Find Out Which Lender Suits You The Best.

Are Property Taxes Included In Mortgage Payments Smartasset

How Your Mortgage Can Affect Your Buy To Let Property Tax Bill

Mortgage Renewal 5 Things You Need To Know

Coming Home To Tax Benefits Windermere Real Estate

Regions Next Step Survey Finds Americans Are Increasingly Pr

Aga Tax Solutions Home Facebook

Over 50 Of Americans Don T Know Their Stimulus Checks Won T Be Taxed Forbes Advisor

Over 50 Of Americans Don T Know Their Stimulus Checks Won T Be Taxed Forbes Advisor

Company Formation Setting Up A Business In Germany

Homebuyer Savings Goals And How The First Time Homebuyer Tax Credit Could Make Them Achievable

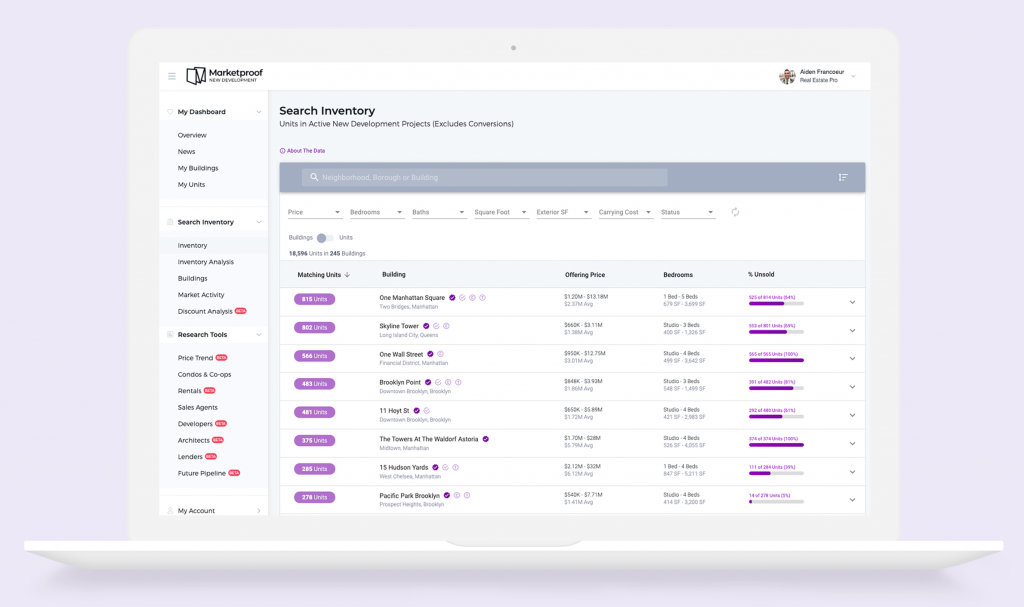

Mortgage Recording Tax All You Need To Know Blocks Lots

Nyc Mortgage Recording Tax Calculator Interactive Hauseit

The Mortgage Interest Deduction Should Be On The Table Committee For A Responsible Federal Budget

Nyc Mortgage Recording Tax Nestapple

Home Mortgage Loan Interest Payments Points Deduction

The Mortgage Interest Tax Deduction Working Class Regression

Publication 936 2022 Home Mortgage Interest Deduction Internal Revenue Service